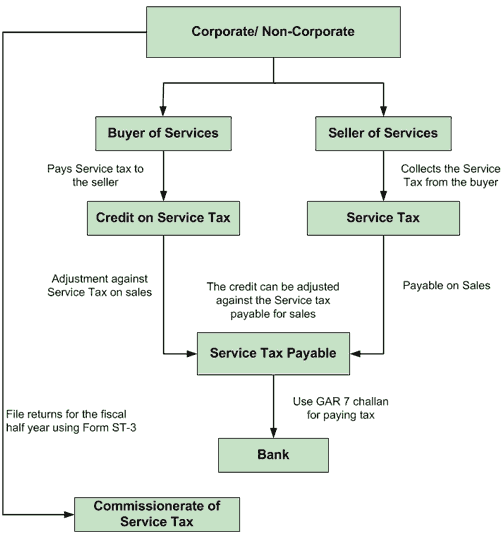

Service tax is an indirect tax which is levied upon the taxable services defined u/s 66B of finance act 1994. Generally the service provider is liable to collect the service tax from service receiver and deposit the same to the central govt. account this account is administered by the Central Excise Department. Generally service provider is liable to deposit service tax to central govt. but in some circumstances service receiver is liable to deposit such tax to central govt. which is popularly known as reverse charge mechanism.

What does service means?

‘Service’ has been defined and means -any activity for consideration carried out by a person for another excluding services under negative list but includes a declared service. The said definition further provides that ‘Service’ does not include