The Limited Liability Partnerships are prominent and popular form of doing businesses in countries across the world. These LLPs are elegant and easy means of combining entrepreneurial initiative with requisite capital and other resources, the professional expertise, and creative knowledge about the business concerned. The taxation liabilities of LLP are different, and generally less than that of the business corporations. Other benefits of limited liability partnerships are outlined in the section below. A LLP is an optional corporate business form that offers advantages of limited liability of an enterprise and the adaptability of a partnership.

Limited Liability Partnerships (LLP) Registration Services

BENEFITS OF LIMITED LIAIBLITY PARTNERSHIP

The outstanding salient features or benefits of the limited liability partnerships are:

- A legally recognized, separate entity with a minimum capital of Rs. 10000

- Limited liability to some partners

- Lesser tax liability than corporations

- Freedom to sort out their management and business affairs directly

- Simple and quick process of registration

- Perpetual existence, irrespective of changes in partners

- A minimum of two partners are required for its formation no restriction to the maximum number of partners

- No minimum capital contribution recommendations

- Less Government intervention.

- Body corporate can be a partner of an LLP.

- No exposure to personal assets of the partners except in a fraud case.

FORMATION OF LIMITED LIABILITY PARNERSHIP

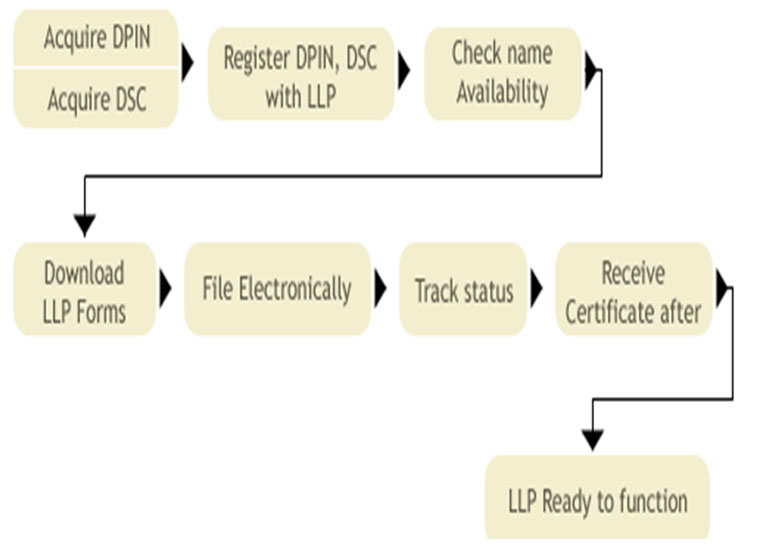

Steps involves in LLp registration

- STEP 1 : Apply DIN

- STEP 2 : Apply for Digital Signatures.

- STEP 3 : File the form for approval of name and get the same approved.

- STEP 4 : LLP Registration Documents filled with Registrar.

- STEP 5 : Obtaining Certificate from Registrar.

- STEP 6 : Making LLP Agreements.

- STEP 7 : Filling Form No. 3.

- STEP 8 : Get other required registrations and licenses needed for different kind of business.

DOCUMENTS REQUIRED FOR REGISTRATION

- ID proof of the proposed Partners: PAN Card, Passport, Election Id, Driving License – anyone (Income-tax PAN is a mandatory requirement as proof of identity for Indian Designated Partners and passport is a mandatory requirement as proof of identity for foreign nationals/Partners.)

- Address proof of the proposed Partners: Passport, election (voter identity) card, ration card, driving license, electricity bill, telephone bill or bank account statement – anyone.

- Passport size photographs of the Designated Partners.

- Address proof of registered office.

What A R P A N & Associates LLP Offers

We offer LLP registration services which are highly renowned as a one-window-solution provider for LLP registration services in Delhi/NCR. We offer professional assistance in getting your LLP Registration at competitive rates and in a short span of time. We area of our with regards to LLP is as follows:Registration serviceAssistance in obtaining DINAssistance in obtaining digital signatureAssistance in all legal and documentation part involve in registration of LLP

- Registration service

- Assistance in obtaining DIN

- Assistance in obtaining digital signature

- Assistance in all legal and documentation part involve in registration of LLP